how much is my paycheck after taxes nj

The standard deduction dollar amount is 12950 for single. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare.

Paycheck Calculator Take Home Pay Calculator

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in New Jersey.

. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and other specialty payroll calculators for all your paycheck and payroll needs. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

If youre a new employer youll pay a flat rate of 28. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. How much is my paycheck after taxes nj Wednesday May 25 2022 Edit.

You are able to use our New Jersey State Tax Calculator to calculate your total tax costs in the tax year 202223. The New Jersey Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and New Jersey State Income Tax Rates and Thresholds in 2022. This calculator is intended for use by US.

Our calculator has been specially developed in order to provide the users of the calculator with not only. The state tax year is also 12 months but it differs from state to state. Similar to the tax year federal income tax rates are different from each state.

Rates range from 05 to 58 on the first 39800 for 2022. Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. New Jersey Hourly Paycheck Calculator.

The United States economy is the largest and one of the most open economies in the world representing approximately 22 of the gross world product. Switch to New Jersey hourly calculator. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New Jersey paycheck calculator. In New Jersey unemployment taxes are a team effort. New employers pay 05.

Switch to New Jersey salary calculator. Divide your annual salary by 52 to calculate your gross weekly pay if your employer compensates you on a salary basis. Divide your annual salary by 52 to calculate your gross weekly pay if your employer compensates you on a salary basis.

How Much Tax Is Taken Out Of My Paycheck New Jersey. New Jersey Salary Paycheck Calculator. Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New Jersey paycheck calculator.

Unemployment Insurance UI. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. How much is my paycheck after taxes nj Tuesday May 3 2022 Edit.

The calculator on this page is provided through the ADP. Important note on the salary paycheck calculator. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

For a single employee paid weekly with taxable income of 500 the federal income tax in 2019 is 1870 plus 12 percent of the amount over 260. Some states follow the federal tax year some states start on July 01 and end on Jun 30. This New Jersey hourly paycheck calculator is perfect for those who are paid on an hourly basis.

How much tax is taken out of a 500 check. Well do the math for youall you need to do is enter the applicable information on salary federal and state. TOP 5 Tips Overview of New Jersey Taxes.

It can also be used to help fill steps 3 and 4 of a W-4 form. Both employers and employees contribute. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major.

How much tax is taken out of a 500 check. Details of the personal income tax rates used in the 2022 New Jersey State Calculator are published below the. For a single employee paid weekly with taxable income of 500 the federal income tax in 2019 is 1870 plus 12 percent of the amount over 260.

Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Ready To Use Paycheck Calculator Excel Template Msofficegeek

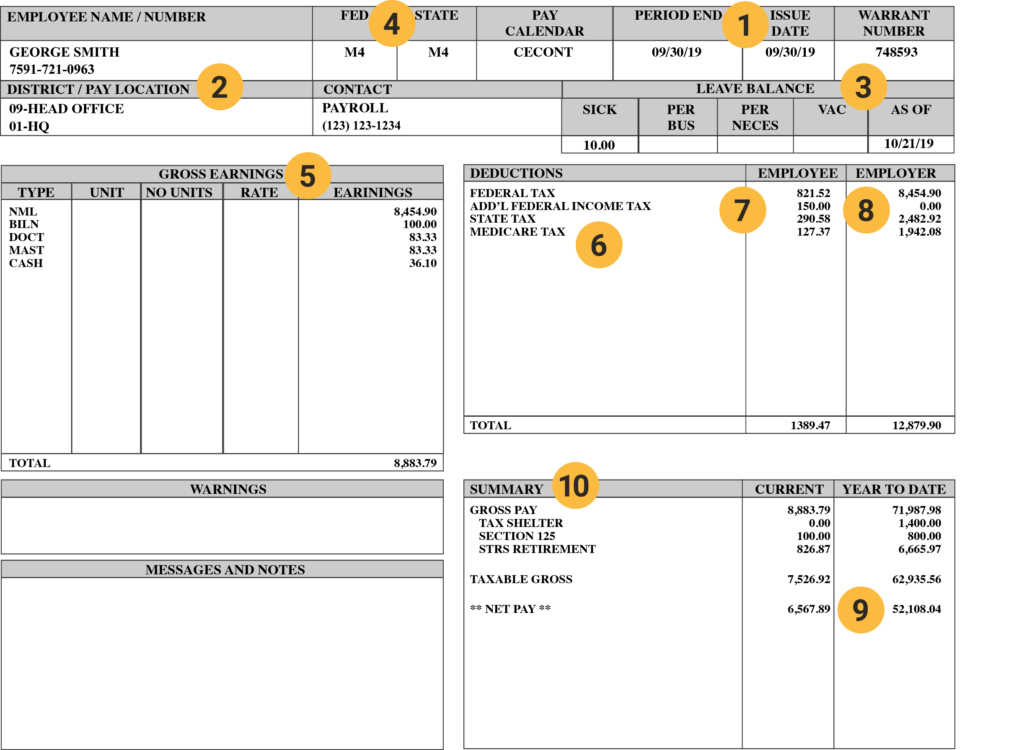

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Financial

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

Different Types Of Payroll Deductions Gusto

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android

What Is Fed Oasdi Ee Tax On My Paycheck Tony Florida Business Tax Deductions Small Business Tax Deductions Tax Deductions

Understanding Your Paycheck Credit Com

Paycheck Calculator Take Home Pay Calculator

Here S How Much Money You Take Home From A 75 000 Salary

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android

Here S How Much Money You Take Home From A 75 000 Salary

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android